all strategy requires understanding the bigger narrative

Insights

Insights shared

December 2024

As we step into 2025, the ESG landscape is evolving rapidly, with investors prioritising climate resilience and adaptation, while social risks gain prominence in equity markets. The rise of artificial intelligence (AI) presents both opportunities and challenges, demanding robust data management and ethical considerations. As these trends converge, businesses and investors must navigate a more dynamic and complex ESG environment to stay ahead and seize emerging opportunities.

Insights shared

november 2024

With President Trump’s recent election victory, the United States faces a shifting policy landscape with profound implications for climate action, environmental stewardship and ESG priorities. Federal rollbacks on climate policies may create uncertainty, leaving the private sector to take on greater responsibility in driving sustainability and addressing social equity.

Insights shared

October 2024

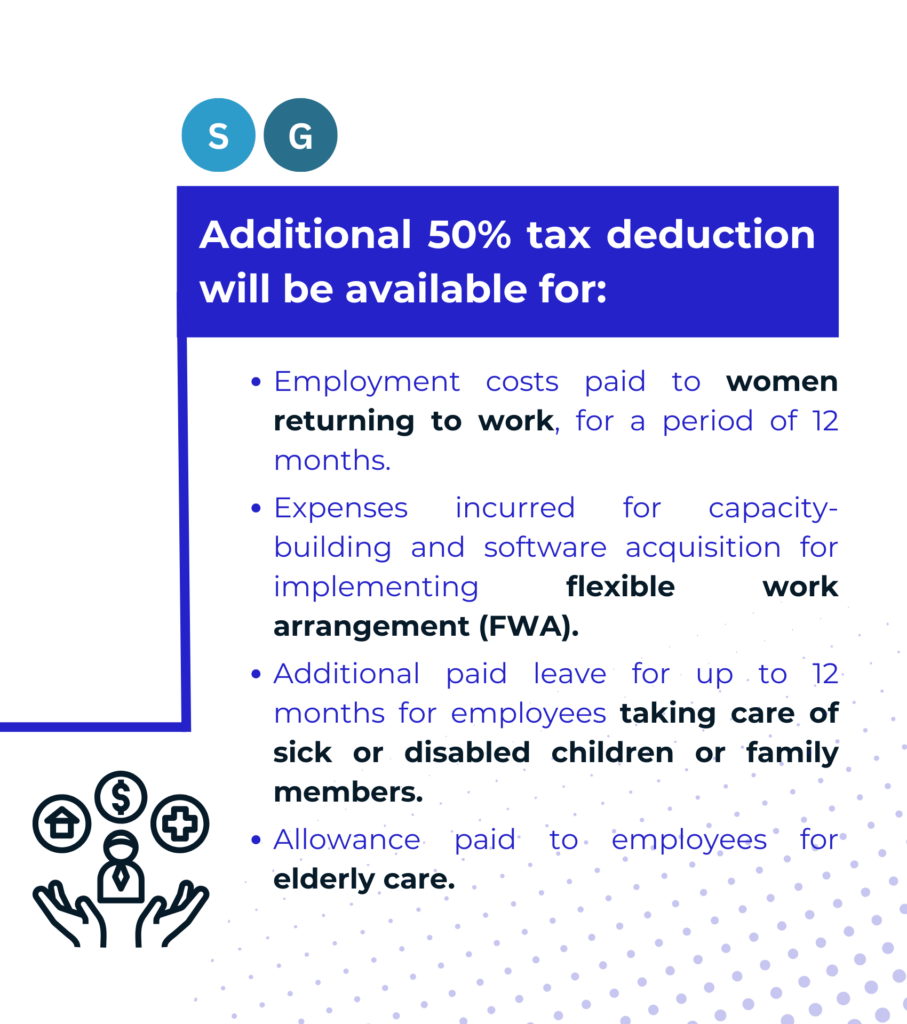

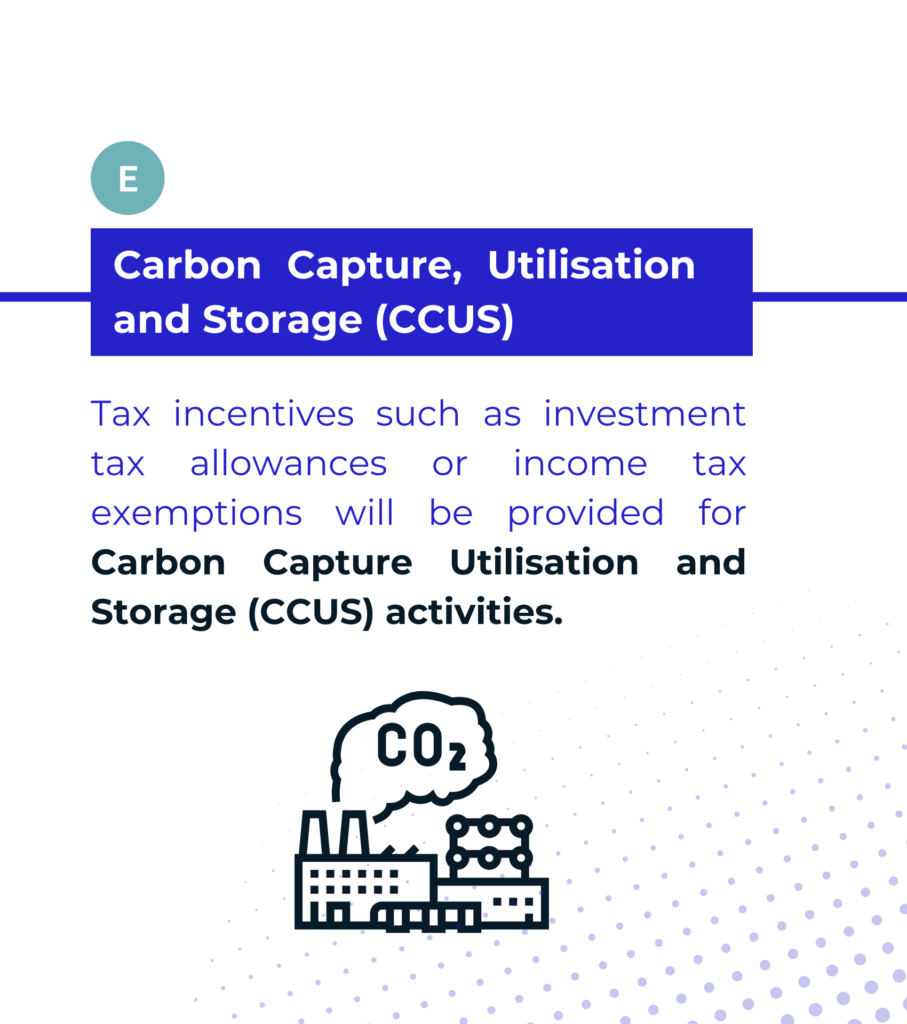

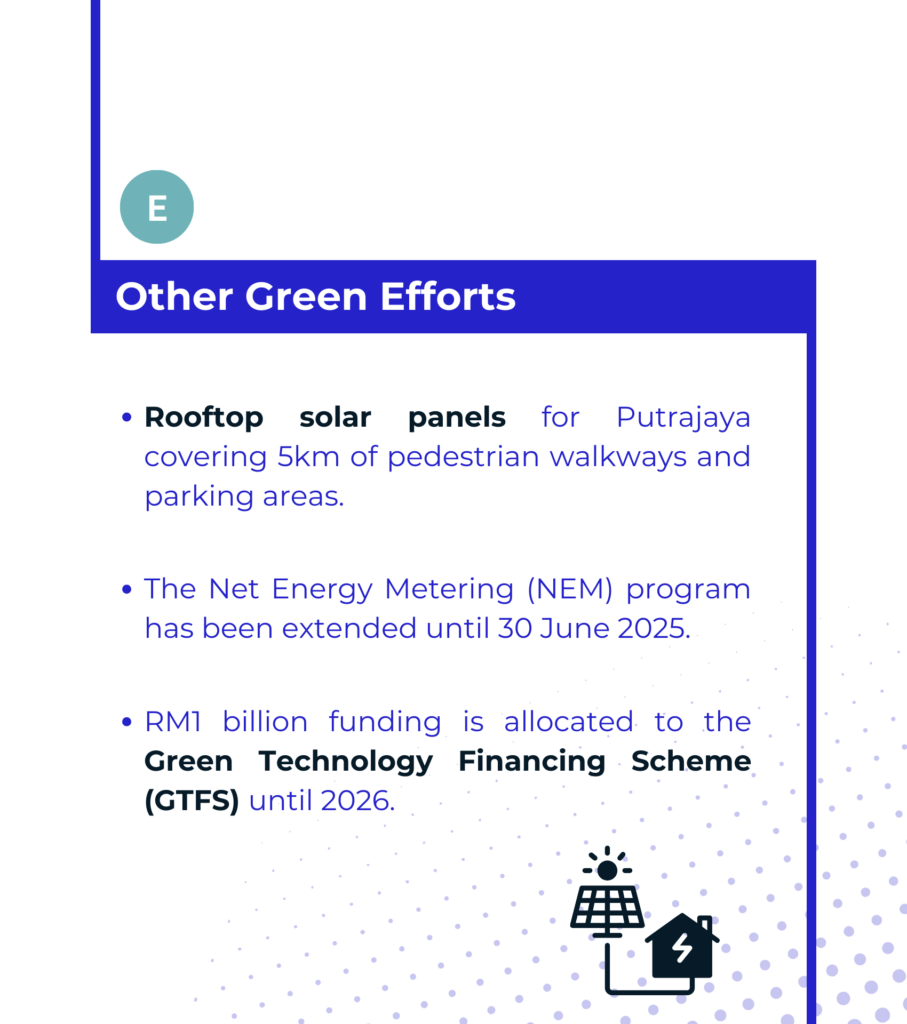

On 18 October, Malaysia’s Prime Mister Anwar Ibrahim presented the third MADANI budget for 2025, with the theme “Revitalising the economy, generating change, prospering the Rakyat” that focuses on economic growth amidst global challenges.

Insights shared

September 2024

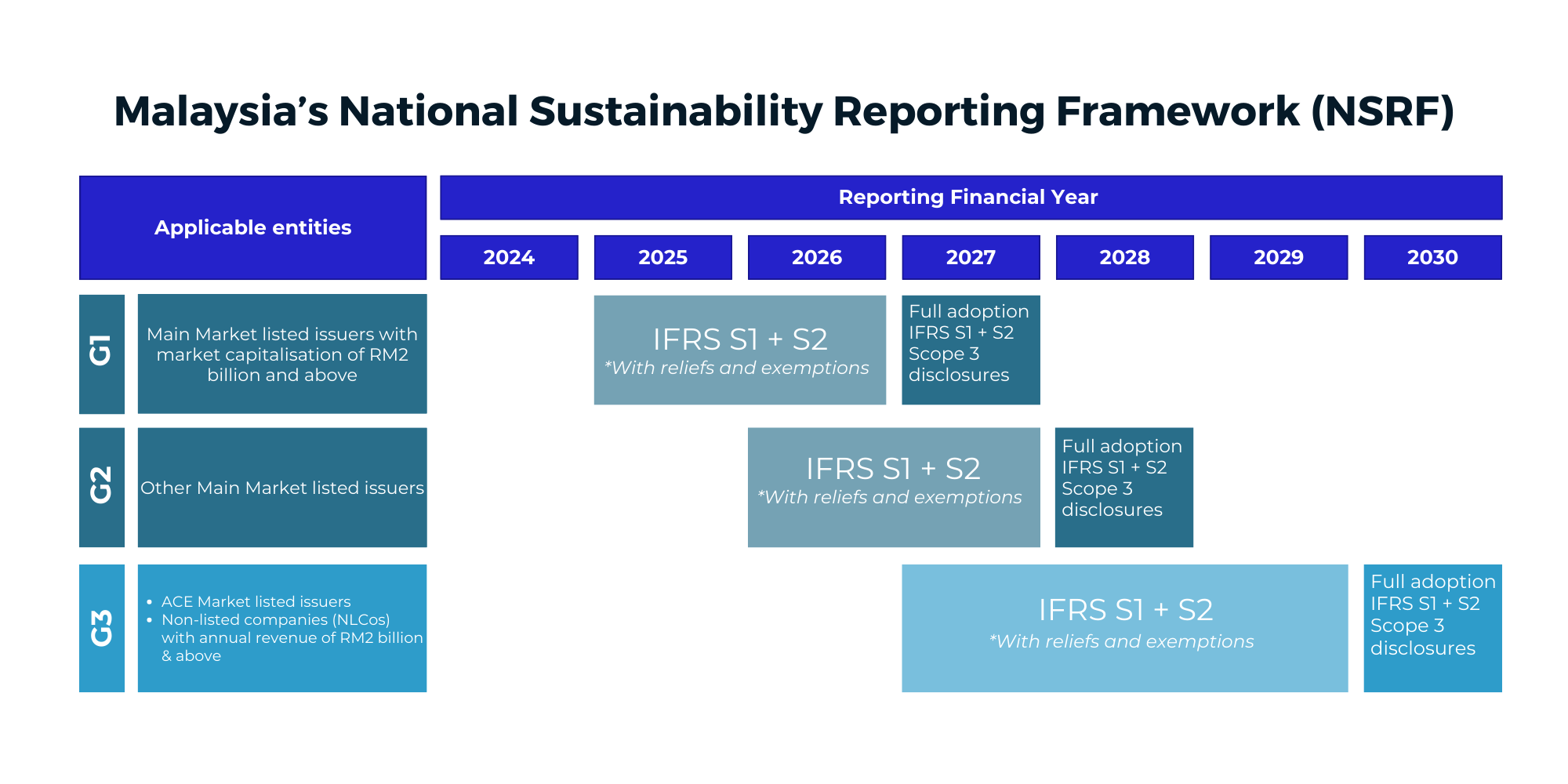

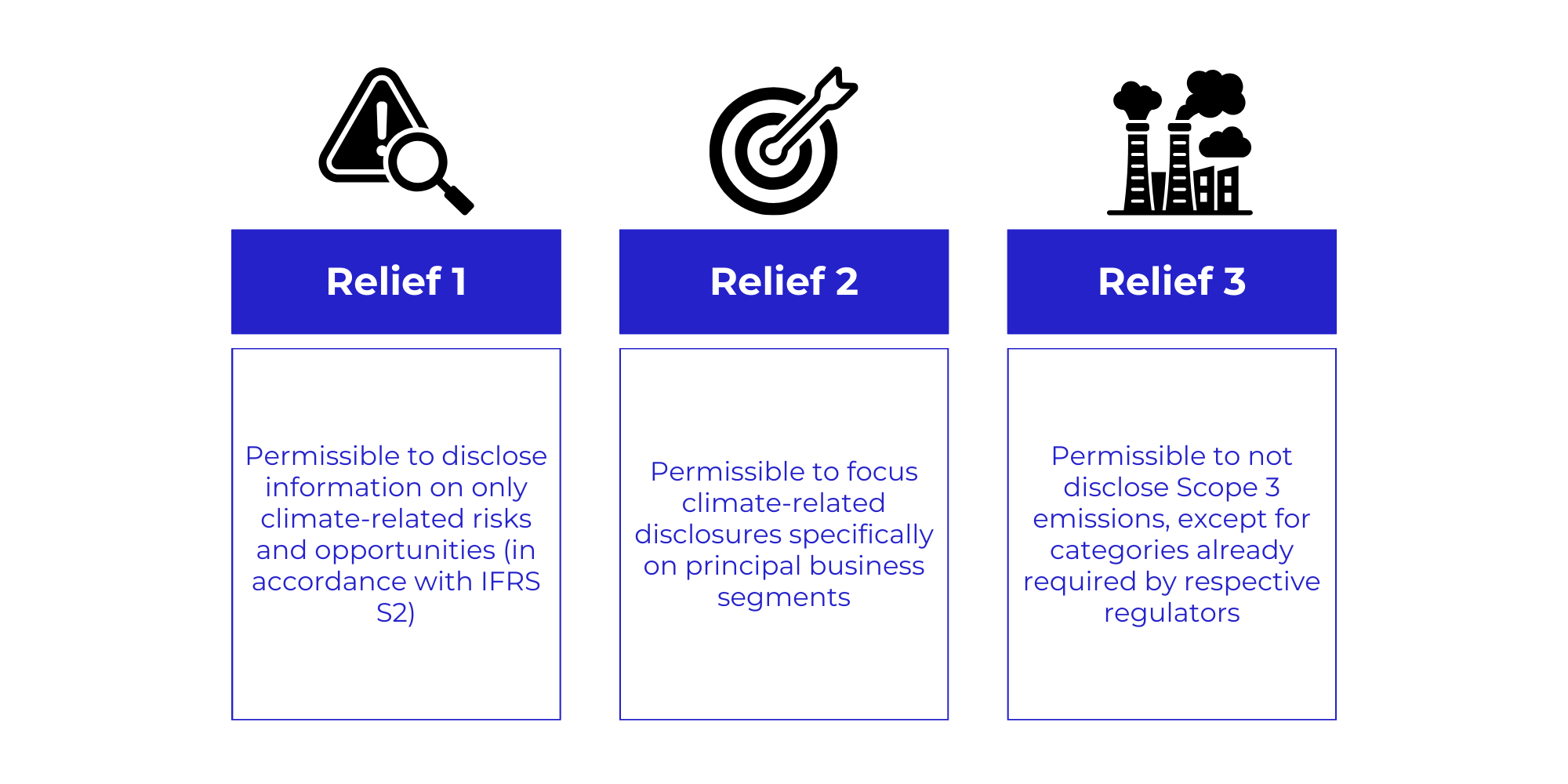

The government has taken a significant step towards enhancing sustainability reporting in Malaysia by launching the NSRF in September 2024. This framework aligns with International Financial Reporting Standard (IFRS) S1 and S2 and will be implemented in phases, starting with large listed companies on the Main Market.

Insights shared

August 2024

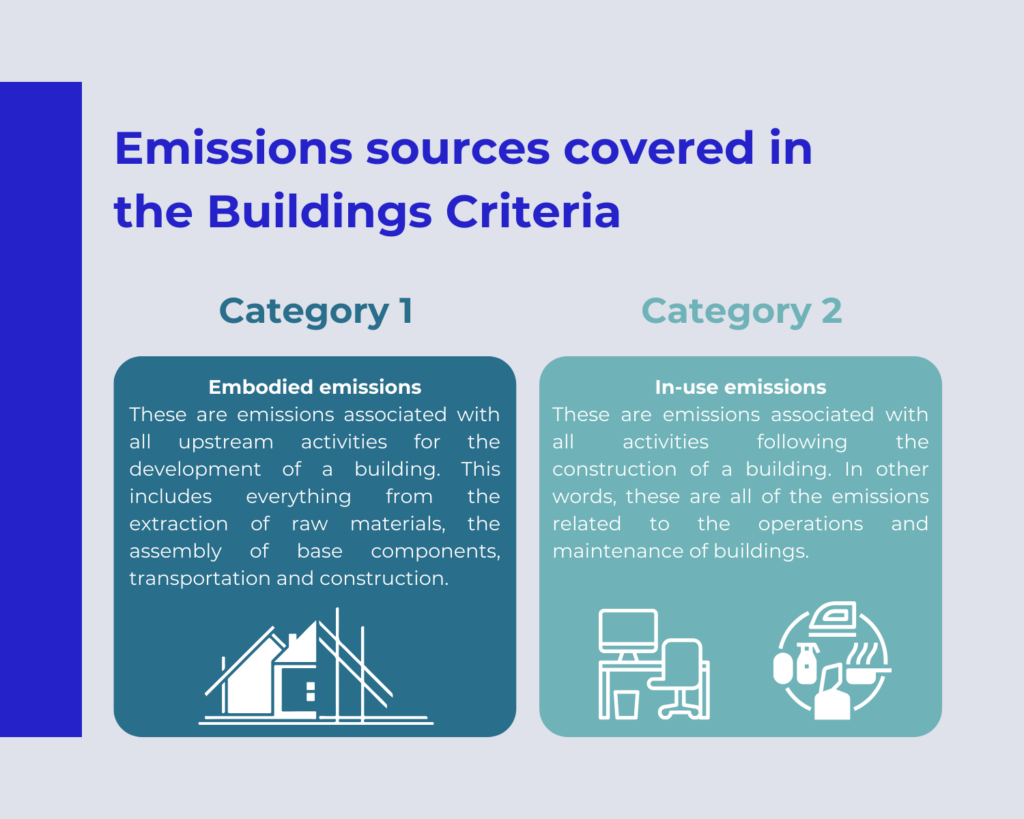

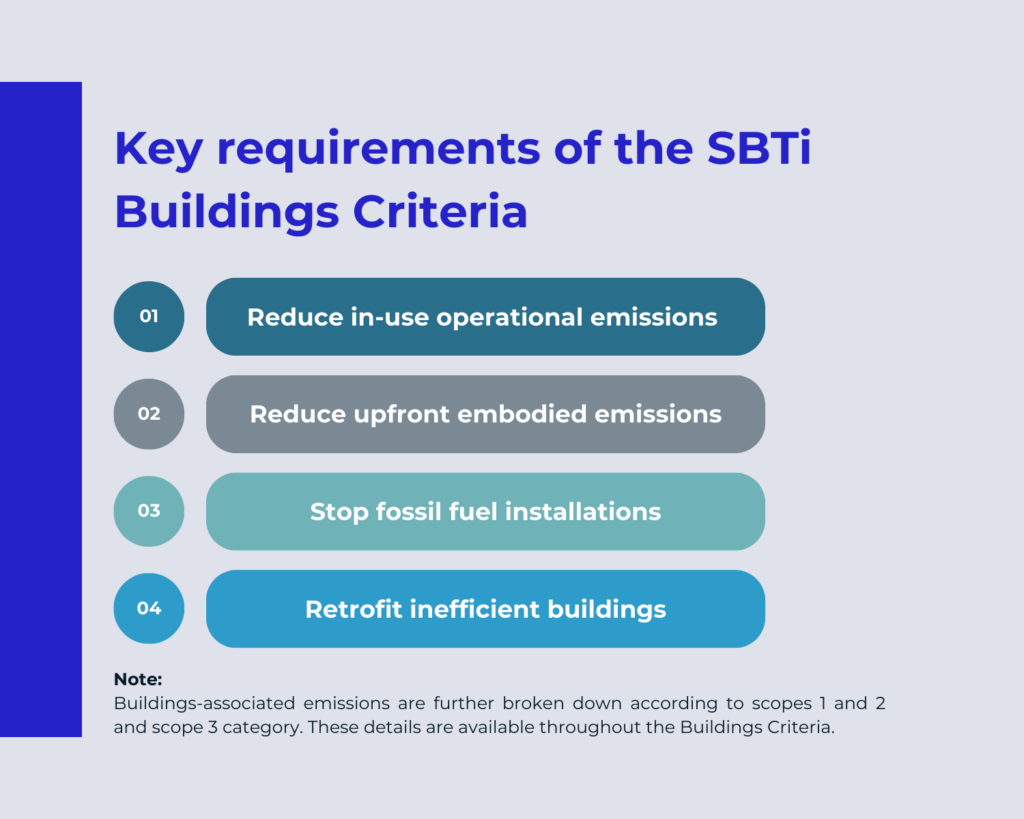

SBTi, a leading organisation in climate action, has pioneered a world-first framework to decarbonise the building sector. This framework provides essential guidance for companies and financial institutions to achieve net-zero emissions in their buildings by 2030.

By developing robust target-setting criteria, tools and supplementary resources, SBTi is empowering businesses to take a proactive stance on ESG issues. This framework not only addresses climate change but also promotes sustainable practices, enhances corporate reputation and attracts environmentally conscious investors.

Insights shared

July 2024

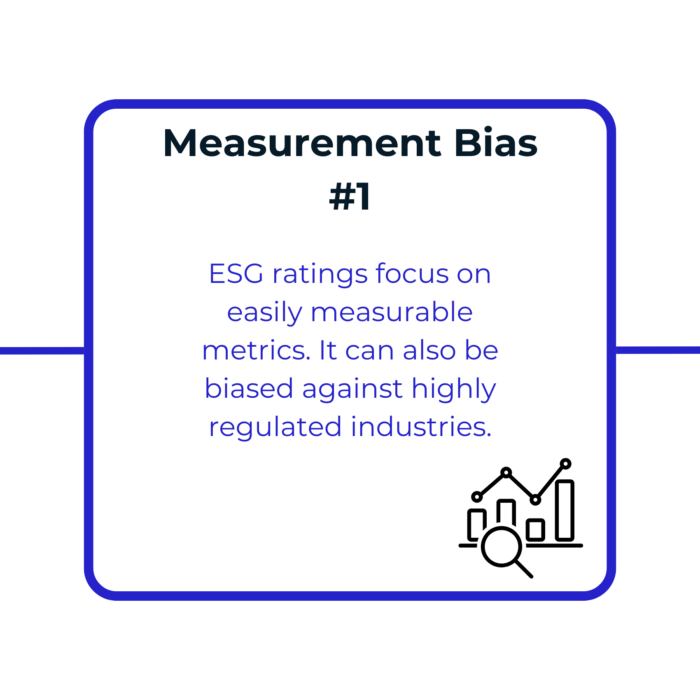

Despite the rapid growth of ESG investing which projected to reach USD50 trillion by 2025, current measurement biases in ESG ratings may be misleading investors. Lauren Cohen, Umit G. Gurun, and Quoc Nguyen propose a two-pronged solution: separating E, S and G factors to allow for a more targeted focus and letting companies declare their ESG priorities to foster transparency and discourages superficiality. Check out the infographic below to read more about how the bias can occur.

Insights shared

June 2024

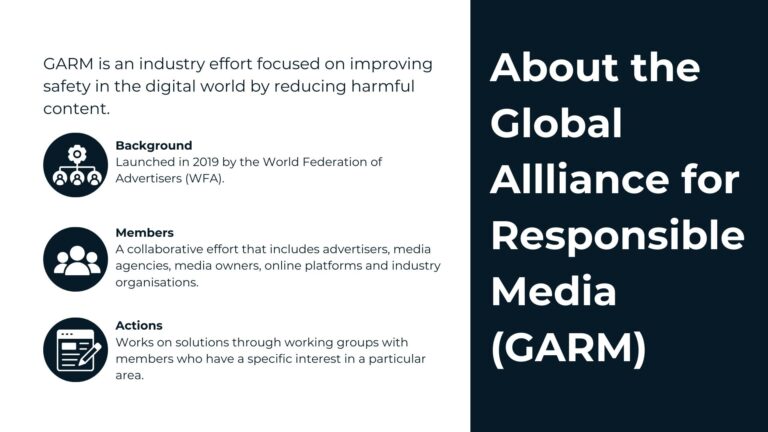

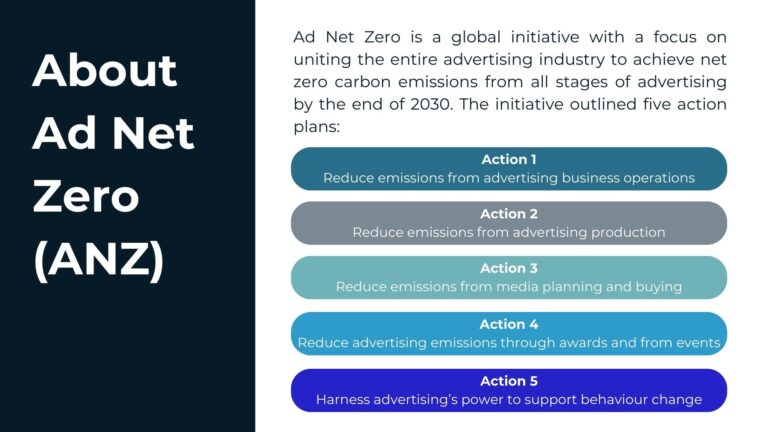

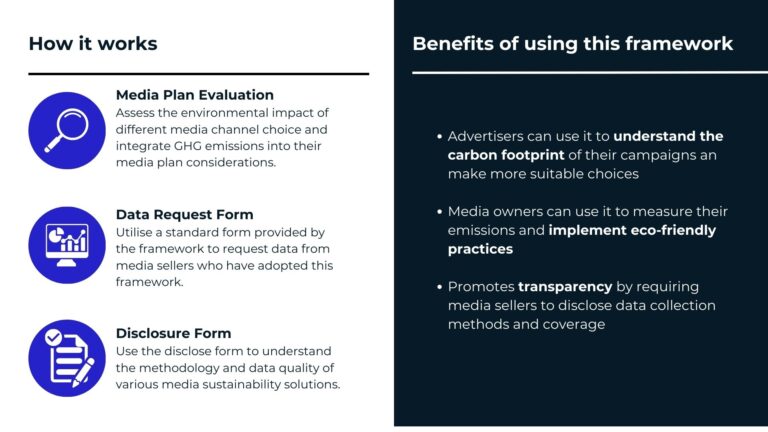

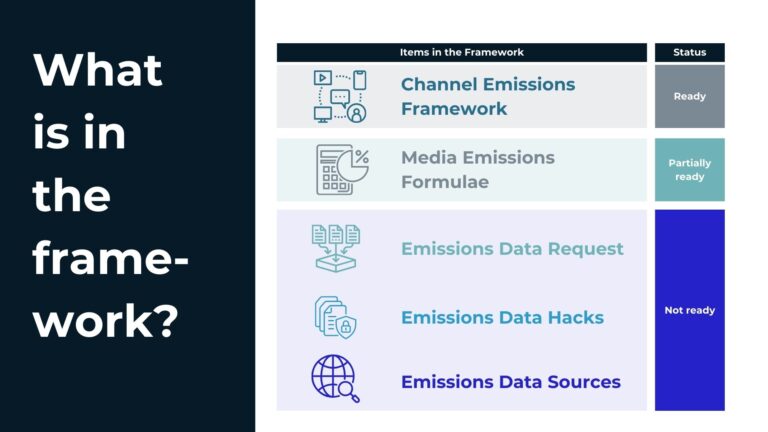

The advertising industry is taking a big step towards sustainability with the launch of the Global Media Sustainability Framework (GMSF) in June 2024. This new initiative, developed by Ad Net Zero (ANZ) and the Global Alliance for Responsible Media (GARM), establishes a standardised approach for measuring greenhouse gas emissions across various media channels, including TV, digital and outdoor advertising. This framework aims to empower advertisers and their partners to make informed decisions about their media plans by understanding their environmental impact. With additional channels like audio, print and cinema to be integrated soon, this initiative has the potential to significantly reduce the carbon footprint of the advertising industry.

Adapted from the The Ad Net Zero Global Media Sustainability Framework (GMSF)

Insights shared

May 2024

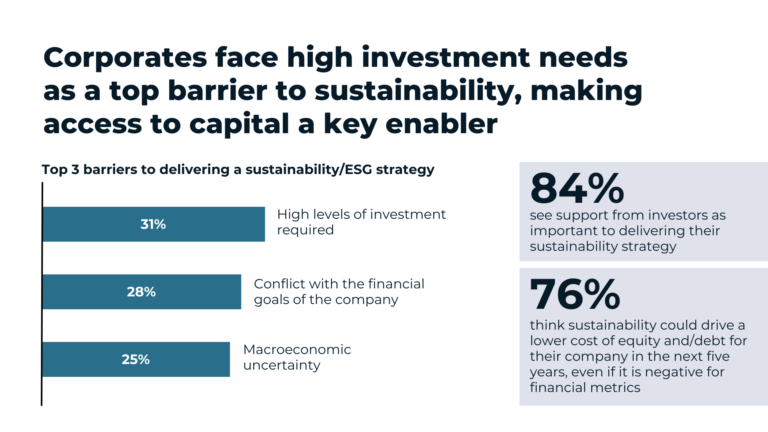

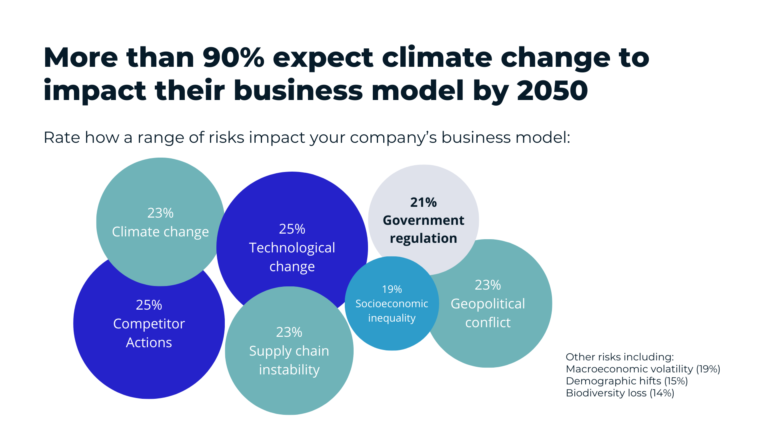

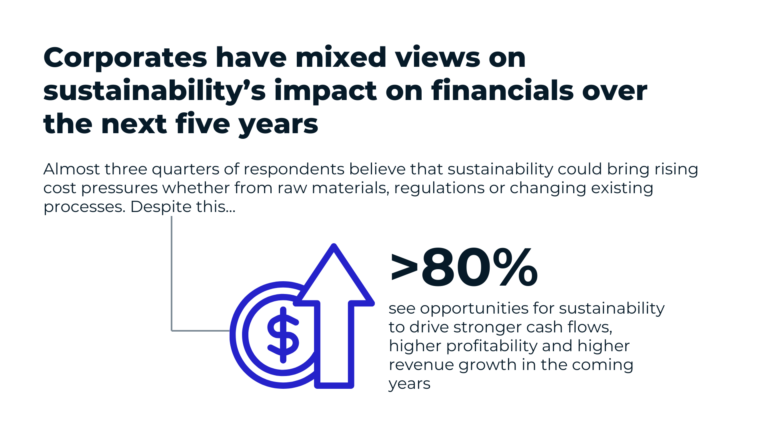

A new report by the Morgan Stanley Institute for Sustainable Investing reveals a significant shift in corporate priorities. Sustainability is no longer a fringe concept, but a central business strategy. Their research, titled “Sustainable Signals: Understanding Corporates’ Sustainability Priorities and Challenges,” surveyed over 300 high-level decision-makers across diverse industries in North America, Europe, and Asia. The report highlights a surprising finding: value creation is the number one reason companies are embracing sustainable practices.

Adapted from Morgan Stanley

Insights shared

April 2024

On the 16th of April 2024, the UN-backed Science Based Targets initiative (SBTi) board of trustees released plans to allow carbon credits in their net zero standard by permitting companies to use them to offset emissions from their supply chains, known as scope 3 emissions.

SBTi certifies whether a company is on track to help limit global heating to under 1.5C and has validated hundreds of net zero plans from companies including J Sainsbury plc, John Lewis and Maersk. Until now, the SBTi has ruled out the use of carbon offsets, instead emphasising the importance of deep greenhouse gas emissions cuts.

Insights shared

March 2024

Amid heightened scrutiny from diverse stakeholders, ESG considerations have gained traction from multinational corporations globally. Global Legal Firm —White & Case presents an insightful article on ‘ESG in APAC: 3 Trends to Watch in 2024’, shedding light on pivotal developments for APAC companies to align with evolving ESG regulations. Here are three significant ESG trends for the APAC region in 2024

Adapted from White & Case

1. Increased risk of liability for greenwashing

2. Growth in sustainability reporting

3. Greater focus on ESG due diligence

Insights shared

February 2024

On 5 February 2024, the European Parliament and Council of the EU announced that they had reached a provisional political agreement on the text of the ESG Ratings Regulation (the Regulation).

This Regulation, first put forth by the Commission in June 2023, aims to establish a regulatory framework for ESG ratings agencies operating within the Union. Positioned within the broader context of the EU’s sustainability efforts, the Regulation aims to enhance the credibility and transparency of ESG ratings, which are increasingly influential as the market for sustainability-focused financial instruments continues to evolve.

Insights shared

January 2024

The GRI Standards, which are globally recognised as the most widely used sustainability reporting standards, are continuously evolving to meet the changing needs of businesses and stakeholders. Beginning of 2024, new sector standards for sustainability reporting are now active for the coal and agriculture, aquaculture and fishing industries, as well as updated standards for biodiversity.

Adapted from ESG Today and global Reporting