all strategy requires understanding the bigger narrative

Archived Insights

Insights shared

December 2023

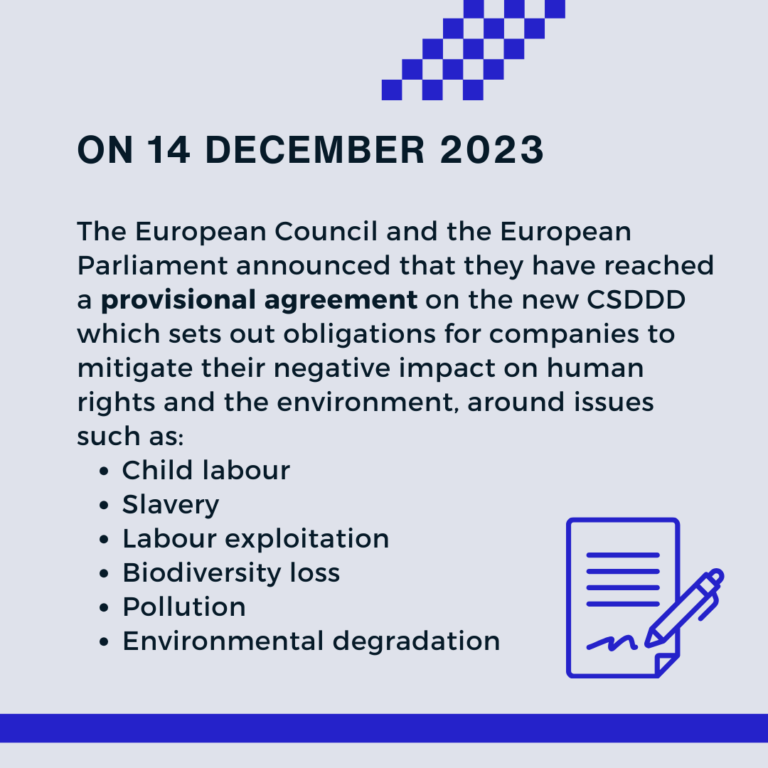

On 14 December 2023, the Council and the European Parliament today reached a provisional deal on the corporate sustainability due diligence directive (CSDDD), which aims to enhance the protection of the environment and human rights in the EU and globally. The due diligence directive will set obligations for large companies regarding actual and potential adverse impacts on human rights and the environment, with respect to their own operations, those of their subsidiaries, and those carried out by their business partners.

Adapted from the Council of the European Union

Insights shared

November 2023

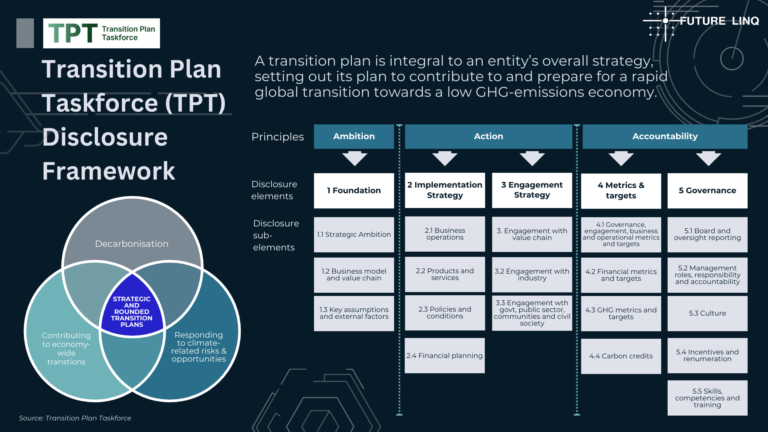

The Transition Plan Taskforce (TPT) has launched its ‘best practice’ disclosure framework for climate transition plans to allow companies and financial institutions to play their part in the shift to net zero. It is aimed at helping companies and financial institutions create consistent, comparable company reports on climate transition plans and reduce the level of disclosure complexity faced by firms. Created by financial institutions including Aviva, Legal & General Asset Management, LSEG and NatWest, and announced at the London Stock Exchange on the 9th of October 2023, the disclosure framework encourages companies to implement a transition plan that takes a strategic and rounded approach in explaining how it will meet climate targets, manage climate-related risks and contribute to net zero, via the principles of ambition, action and accountability.

Adapted from the Transition Plan Taskforce (TPT)

Insights shared

October 2023

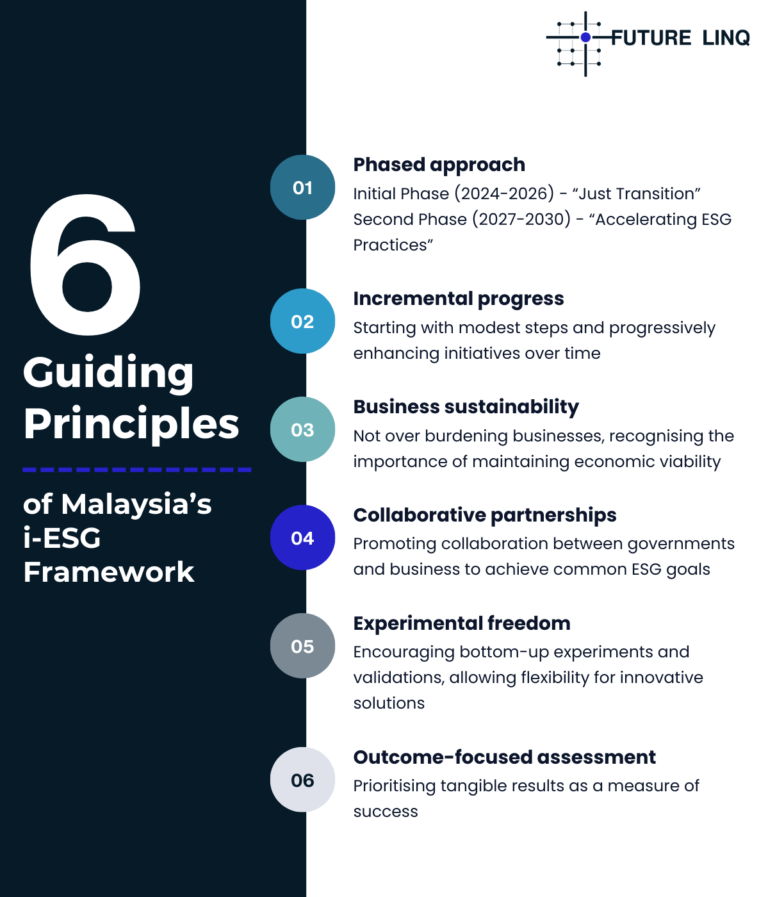

Early October 2023 marked the launch of the National Industry Environmental, Social and Governance (ESG) Framework (i-ESG Framework) by Malaysia’s Ministry of Investment, Trade & Industry (MITI). This framework aims to accelerate transition towards sustainable practices among manufacturing companies and achieve a net-zero transition.

The Phase 1.0 of the Framework focuses on increasing awareness, delivering training and providing financial support to assist MSMEs along their journey to adopt ESG.

Adapted from the Malaysian Ministry of Investment, Trade and Industry (MITI)

Insights shared

September 2023

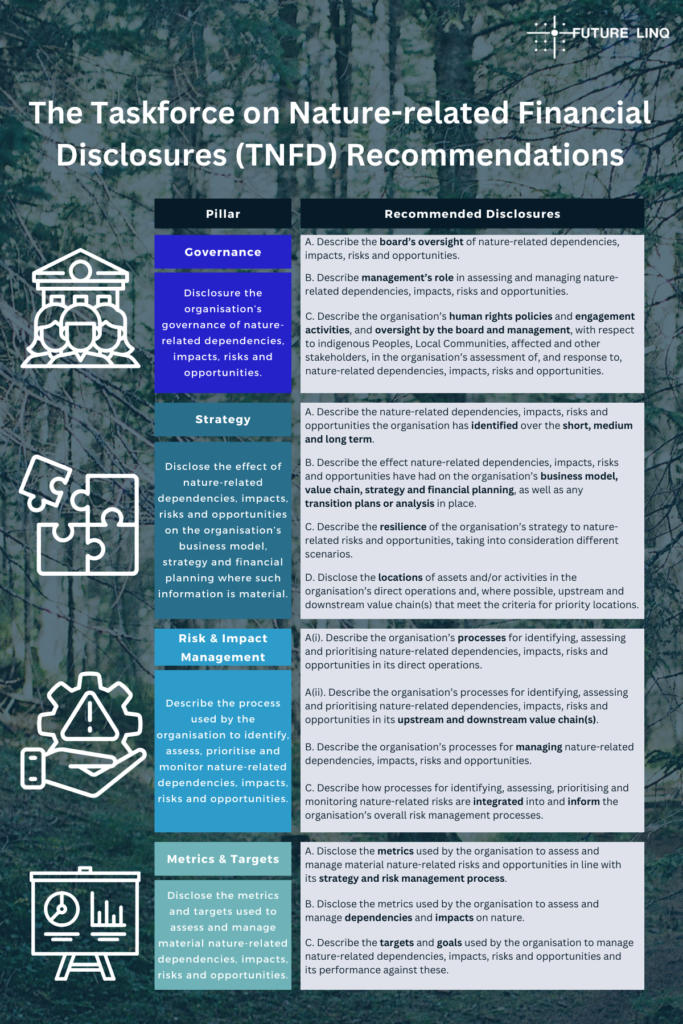

The recommendations of the TNFD have been designed to meet the corporate reporting requirements of organisations across jurisdictions, to be consistent with the global baseline for corporate sustainability reporting and to be aligned with the global policy goals in the Kunming-Montreal Global Biodiversity Framework. The TNFD disclosure framework consists of conceptual foundations for nature-related disclosures, a set of general requirements, a set of recommended disclosures structured around the four recommendation pillars of governance, strategy, risk and impact management, and metrics and targets. This is consistent with the approach of the TCFD and the ISSB’s IFRS Standards.

Insights shared

August 2023

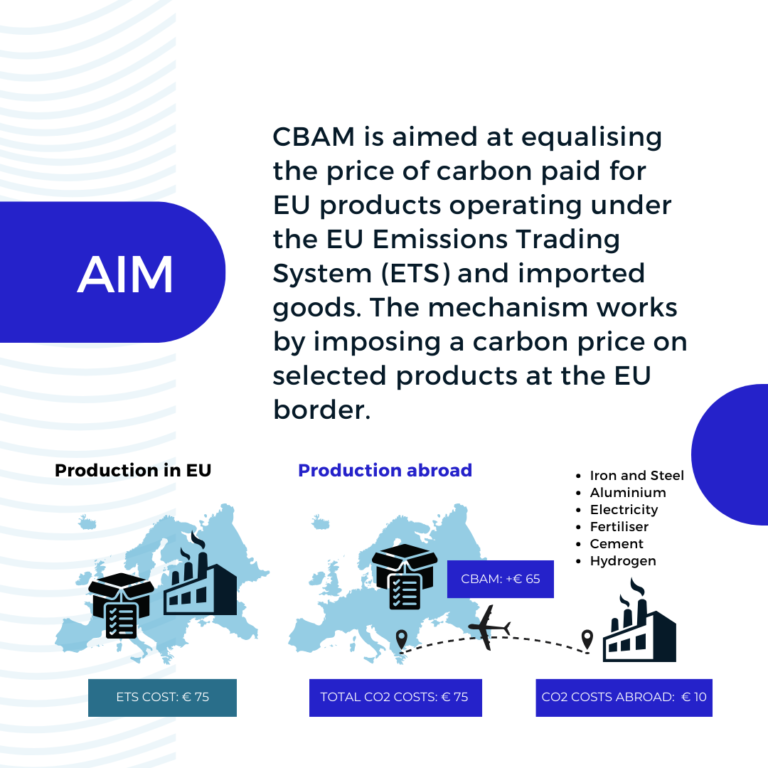

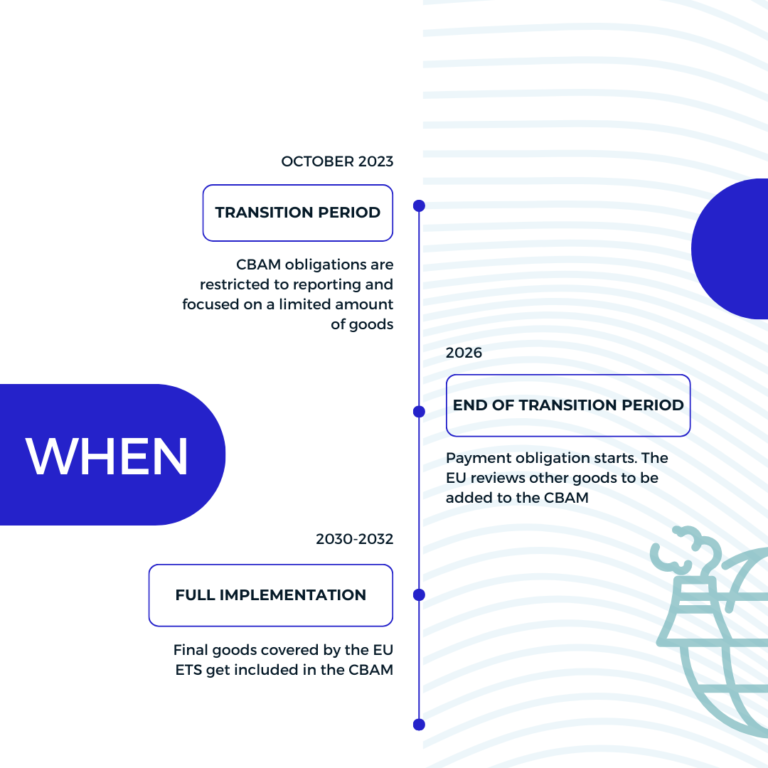

The EU’s Carbon Border Adjustment Mechanism (CBAM) is our landmark tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries. The gradual introduction of the CBAM is aligned with the phase-out of the allocation of free allowances under the EU Emissions Trading System (ETS) to support the decarbonisation of EU industry.

Insights shared

July 2023

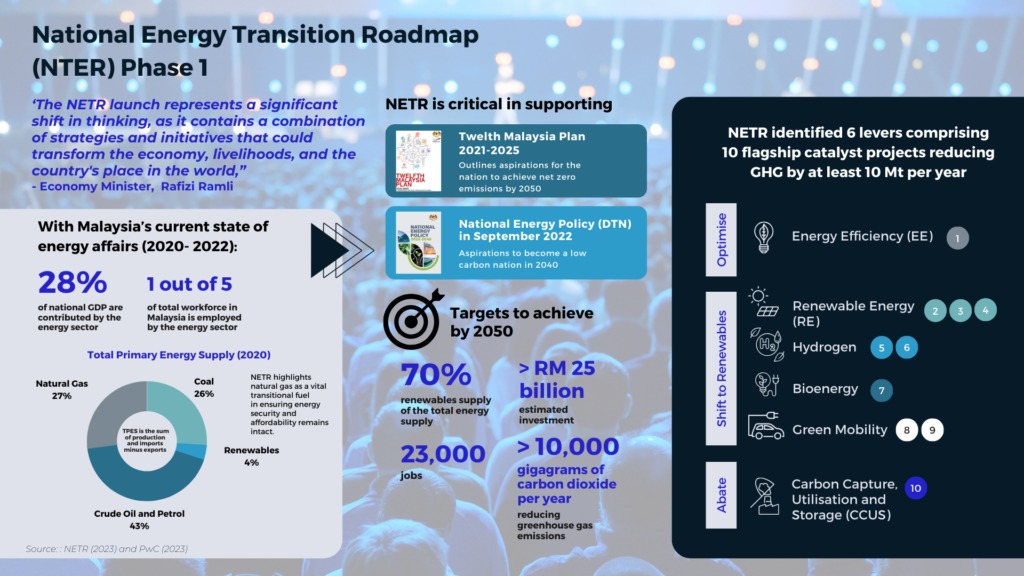

27th July 2023 marked the launch of Malaysia’s National Energy Transition Roadmap (NTER) Phase 1 which comprises 10 flagship catalytic projects.

“The NTER would help us transform our economy by opening up profitable ventures that are good for the environment and good for the economy,” said Rafizi Ramli, the Minister of Economic Affairs.

As Malaysia transitions towards sustainable energy systems, businesses operating in Malaysia would have to align their strategies with the NTER and adopt cleaner energy sources and practices to attract ESG-focused investors.

Insights shared

June 2023

This month marked the issuance of the inaugural IFRS Sustainability Disclosure Standards, designed to provide a global baseline of sustainability-related disclosures for the capital markets. IFRS S1 requires companies to communicate the sustainability-risks and opportunities they face over the short, medium, and long term. IFRS S2 sets out specific climate-related disclosures and is designed to be used with IFRS S1. Both Standards are based on recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

Insights shared

May 2023

It is becoming increasingly essential for companies to understand and address the effects that externalities can have on their social license. The latest McKinsey Global Survey on environmental, social and governance (ESG) issues asked more than 1,100 respondents in more than 90 countries how their organisations are rising to this challenge.

Insights shared

April 2023

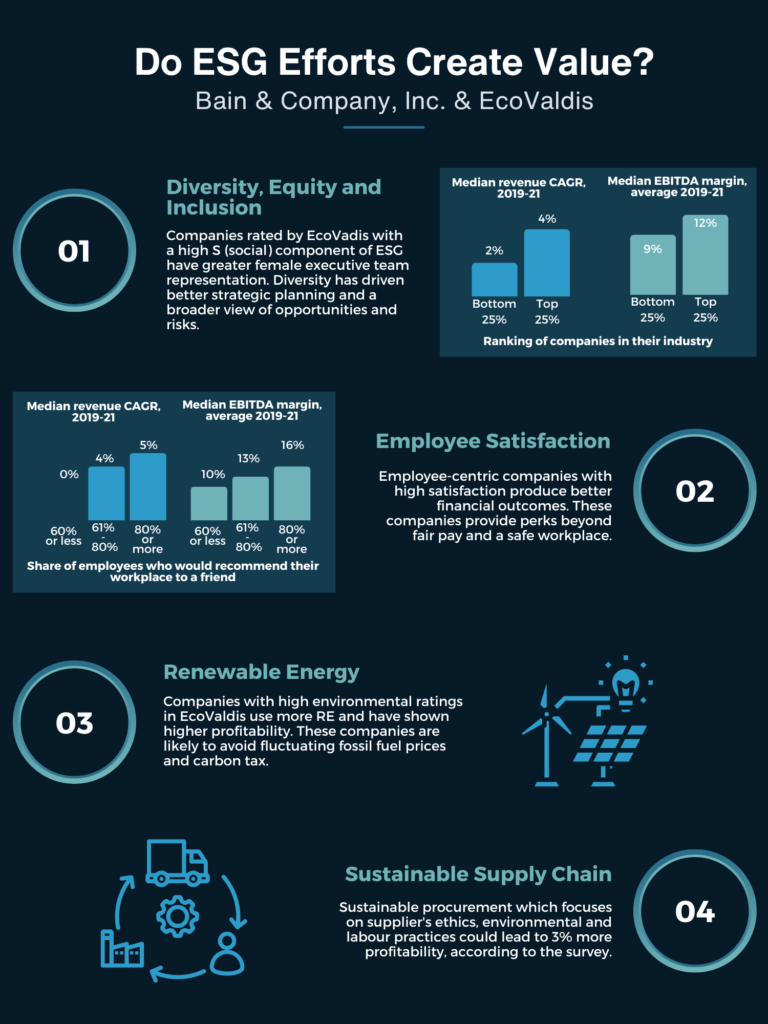

Research by Bain & Company and EcoVadis indicates that positive ESG outcomes are a trait of successful companies. Bain worked with EcoVadis to assess, for the first time, how ESG activities impact the 100,000 companies tracked by EcoVadis, more than 95% of which are private

Insights shared

March 2023

Speaking at the recent BNP Paribas’ ESG APAC Outlook 2023, experts discussed how significant developments in regulation, multilateral cooperation, transition finance and the growth of green bonds will shape the agenda in 2023.

Excerpts from BNP Paribas

The regulatory bar will be raised,

with more regulators to protect the integrity of the market with a focus on greenwashing.

Looking ahead to COP28,

which will build on agreements made last year, especially the Loss and Damage fund.

Transition finance to make a comeback,

as OECD Guidance and G20 Framework set to drive a credible transition to sustainability.

Strong issuance of ESG debt,

with China leading the way in sustainable bonds and South Korea at the forefront of social bonds.

Insights shared

february 2023

This month’s updates signal that regulators worldwide are emphasising the idea that sustainability regulation does not necessarily overwrite existing rules, but rather serves to provide guidelines for the consistent interpretation of a modified rules-based system of governance for more robust financial markets.

Excerpts from ESG Book

Policy

February saw a flurry of regulatory activity that signals the continuity and confluence of ESG in policymaking matters

International

Nations Agree on Historic Oceans Treaty

After a decade of negotiations, nations have achieved a landmark accord to safeguard the world’s oceans. The High Seas Treaty seeks to secure and restore marine ecosystems by designating 30% of the oceans as protected areas by 2030.

Europe

Provisional agreement reached on European Green Bond Standard

Key negotiators in the European Parliament have established the first ‘best-in-class’ green bond standard. Companies issuing green bonds in accordance with the standards can communicate the use of proceeds in a substantive disclosure.

Europe

ECB publishes staff opinion on draft European Sustainability Reporting Standards (ESRS)

The European Central Bank has expressed support for the draft ESRS which strengthens the implementation of sustainability disclosure requirements under Corporate Sustainability Reporting Directive (CSRD). The draft ESRS would help financial and credit institutions enhance the assessment of climate-related risk and resilience.

Europe

European Commission unveils Green Industrial Plan and ‘transition framework’

Following the passage of the Inflation Reduction Act (IRA) in the US, EU lawmakers pushed for a centralised plan to provide clean energy financing and subsidies that would help maintain competitiveness with US businesses.

Europe

EU Parliamentary committee votes to strengthen climate “due diligence” obligations

In a landmark move, the EU environment committee voted to put in place stricter climate due diligence obligations for large companies and SMEs. CSRD is the newest legislation that requires companies to minimise adverse environmental impacts and prevent human rights violations across the value chain.

Europe

European Insurance and Occupational Pensions Authority (EIOPA) issues 2023 supervisory convergence plan focusing on ESG risks

The European pensions and Insurance regulator EIOPA published a Supervisory Convergence Plan for 2023 which includes a section on enhancing quality capital requirements (the second pillar of Solvency II plans). This means that the own risk and solvency assessment (ORSA) under the EU’s Solvency II directive may be adapted within the context of climate change.

Europe

European Commission unveils Green Industrial Plan and ‘transition framework’

Following the passage of the Inflation Reduction Act (IRA) in the US, EU lawmakers pushed for a centralised plan to provide clean energy financing and subsidies that would help maintain competitiveness with US businesses.

United Kingdom

UK CMA publishes guidance on competition laws applicable to environmental sustainability agreements

The UK’s Competition and Markets Authority (CMA) issued guidance for firms seeking opportunities to collaborate without breaching competition laws. The regulator illustrated use cases where rules would be “permissive” to help competitors share the costs and burden of mitigating climate change.

Asia Pacific

Indian central bank announces regulatory guidelines on climate risk and sustainable finance

On July 27, 2022, the Reserve Bank of India (RBI) published a discussion paper on climate risk and sustainable finance to solicit feedback from regulated entities on proposed changes in monetary policy. Based on public comments and analysis of feedback, the RBI released a framework for the acceptance of green deposits, disclosure requirements for climate-related risks and guidance on climate scenario analysis and testing.

Asia Pacific

Indian securities regulator sets operational guidelines on green bonds

Under the new set of green bond guidelines, issuers of green debt instruments must outline sustainability objectives in the offer document. Issuers must also disclose details for determining the eligibility of financed projects and the use of proceeds.

Asia Pacific

SEBI proposes new categories of ESG schemes for mutual funds

The Securities and Exchange Board of India (SEBI) proposed a new rule to create five new types of ESG mutual fund schemes – exclusions, best-in-class, integration, positive screening, impact and sustainable objectives.

Asia Pacific

Chinese regulators poised to adopt mandatory ESG disclosure requirements

Regulatory authorities in China are considering the introduction of mandatory ESG reporting requirements for all public companies listed in China. According to the proposal, regulators are initially looking at having the new disclosures apply on a ‘comply or explain’ basis.

Asia Pacific

Philippine SEC introduces guidance on sustainability-linked bonds

On February 2, 2023, the Securities and Exchange Commission (SEC) of the Philippines released a preliminary memorandum circular (MC) for public feedback regarding the issuance of sustainability-linked bonds (SLB) in the Philippines, in accordance with the ASEAN Sustainability-Linked Bond Standards (ASEAN SLBS).

Asia Pacific

Singapore Green Taxonomy in final consultation phase

Singapore is set to finalise its green and transition taxonomy for financial institutions. The final consultation seeks input from stakeholders on thresholds and criteria for five sectors: agriculture and forestry/land use; industrial; waste and water; information and communications technology; and carbon capture and sequestration.

Insights shared

january 2023

Heading into 2023, the pressure will continue to build as a broader set of stakeholders (including shareholders, regulators, employees, customers and community members) expect companies across geographies and industries to take action on a wide set of ESG-focused concerns. Navigating risk and opportunity will require calibrated solutions that balance these competing priorities, and which are aligned with long-term sustainability and profitability. It will demand targeted, measurable and trackable action plans and—in some cases—tradeoffs.

Excerpts from Harvard Business Review

"Our consumers are very sensitive to social and environmental issues. We have actively engaged with them on these issues in the last ten years, and they have become very aware as consumers. They especially ask for information on environmental policies, workers' rights and product safety."

Walter Dondi, Director of Co-op Adriatica, Italy’s largest retailer